The only thing you'll need to read in order to catch up with DePIN thesis.

Crypto has spent over a decade fumbling around, trying to justify its existence.

NFTs, play-to-earn, socialfi, memecoins, hard money, soft money, ultrasound money, sandwich bots, outright crime — all fun experiments, but ultimately just financial reshuffling inside a walled garden (of just 30m people).

Arguably, the only undeniable product it has produced for the world so far is stablecoins and some DeFi products that utilise them. All this time, the crypto universe has essentially been an assortment of siloed financial ledgers that move limited value through space and time. Subsequently, all the PMF we ever found has always been either directly financial or indirectly financial by nature.

The ultimate crypto edge is financialisation of different processes of humans daily life. SocialFi, GameFi, DeFAI and others ultimately bring the Fi aspect to the proven PMFs, trying to find a 10x iteration in the corresponding verticals.

If you've been sleeping on DePIN, or if you're new to crypto and wondering what else is there besides explicit finance, this guide will bring you up to speed.

In this guide, we'll explore:

- What DePIN is

- The core thesis behind it

- Current projects and development

- Why it matters for you

What is DePIN?

DePIN, or Decentralized Physical Infrastructure Networks, refers to the use of public blockchain and token incentives to crowdsource the deployment and operation of real-world physical infrastructure.

This includes networks for wireless communication, energy grids, data storage, automobiles, compute power, and more. These networks aim to create user-owned and resilient infrastructure by incentivising individuals to contribute resources and participate in the system, replacing the traditional centralised company model.

Many DePINs challenge established giants like Google Street View or AWS, which makes some people skeptical. They believe these monopolies are too entrenched to disrupt. However, this skepticism overlooks a key point: while monopolised industries may appear stable, they often harbor deep-rooted inefficiencies that have persisted for decades. These inefficiencies present the perfect opportunity for DePIN solutions to succeed.

The playbook is simple:

- Identify an industry where capital barriers have made competition impossible.

- Introduce tokens as economic incentives to remove those barriers.

- Let grassroots activity outscale central planning at a rate incumbents cannot match.

While social media, creator economies, and AI agent deployment are areas that excite the crypto community, these sectors remain open to disruption through traditional means. In fact, the most significant breakthrough products in these verticals have emerged from non-crypto solutions, though such breakthroughs have been rare. These industries simply make it more challenging to deliver solutions that are 10x more valuable than existing options.

In contrast, industries like Telecom, Energy, Mapping, PNT, Automobiles, and Cloud Compute have become virtually impenetrable without billions of dollars in investment. It is here that DePINs are proving their worth as the new feasible way to break into the capital-intensive markets.

DePINs are unleashing a wave of grass-root innovation that outpaces centralised planning and redefines the competitive landscape, achieving 10x-100x cost efficiencies versus centralised models while maintaining enterprise-grade service levels. It's obviously faster for people to deploy infrastructure like Helium’s mobile hotspot than for a traditional company like Verizon that would need to find land, acquire permission to buy it or lend it, build the cell tower, etc.

The Monopoly Problem: Why Markets Stay Inefficient

The biggest myth in business is that monopolies exist because they're the most competent at what they do. They don't. They exist because the barriers to entry are too expensive for competitors. Look at any major market and research its cost structure, and you'll likely find something like this:

Telecom? Building a single cell tower costs ~$200,000 in the US, with major carriers typically spending 15%+ of revenue on capital expenditures. Beyond the tower structure itself, each site needs radio equipment (antennas, base stations) and power/backhaul connectivity, plus billions in spectrum rights, and all that before even attempting to serve customers. To achieve nationwide coverage comparable to incumbents, a new entrant might need on the order of tens of thousands of towers.

Cloud computing? Major providers like AWS and Microsoft spend $166B annually on data centers, with construction costs reaching $12M per megawatt. A single 60MW facility in Northern Virginia costs $770M to build, while operational expenses consume $25M/year for power and cooling alone.

Logistics, Mapping, RTKs, Automobiles, etc. These industries have only been monopolising because they’re too expensive for anyone new to enter.

Incentive Alignment

Traditional infrastructure takes decades to build because it follows a top-down, capital-intensive model:

- Raise billions.

- Deploy infrastructure.

- Pray that users show up before you run out of money.

DePIN flips this model on its head:

- Introduce a token.

- Token is distributed to people who are already naturally performing the core business activity (like mapping areas during their daily drives).

- Token rewards compensate users for purchasing DePIN hardware.

- Watch as it outgrows centralized alternatives at an impossible speed (examples below).

DePIN’s model is to identify a useful form of work and align incentives around performing said work. Most often via using a specialised hardware.

The result? 10x the speed, 1/100th the cost.

And the craziest part? This isn’t theoretical—it’s already happening.

Here’s Helium Mobile as an example:

Grassroots Networks Always Win Against Central Planning

The reason this works isn't magic—it's just basic economics.

When you build a network the traditional way, you're forcing a structure onto the market before demand exists. This approach is slow, expensive, and fragile.

But when you let people contribute naturally, the network bootstraps itself from the ground up, perfectly matching real demand in real time.

This explains why **Hivemapper mapped 10 million miles in just two years**—a feat that took Google Street View an entire decade.

Google had to:

- Purchase expensive mapping vehicles

- Cover salaries, insurance, and massive corporate overhead

- Deploy cars region by region, leading to outdated map data

Meanwhile, Hivemapper simply rewards people for attaching a dashcam to their cars and going about their daily lives.

That's it. No billion-dollar budget. No vehicle fleet. Just pure incentives doing what they do best.

The elegance of this setup is mind-boggling. It completely flips the traditional market structure on its head—and it's only possible through crypto. So far, the innovation has remained largely within expert circles, yet to catch mainstream media attention, creating an opportunity for early adopters.

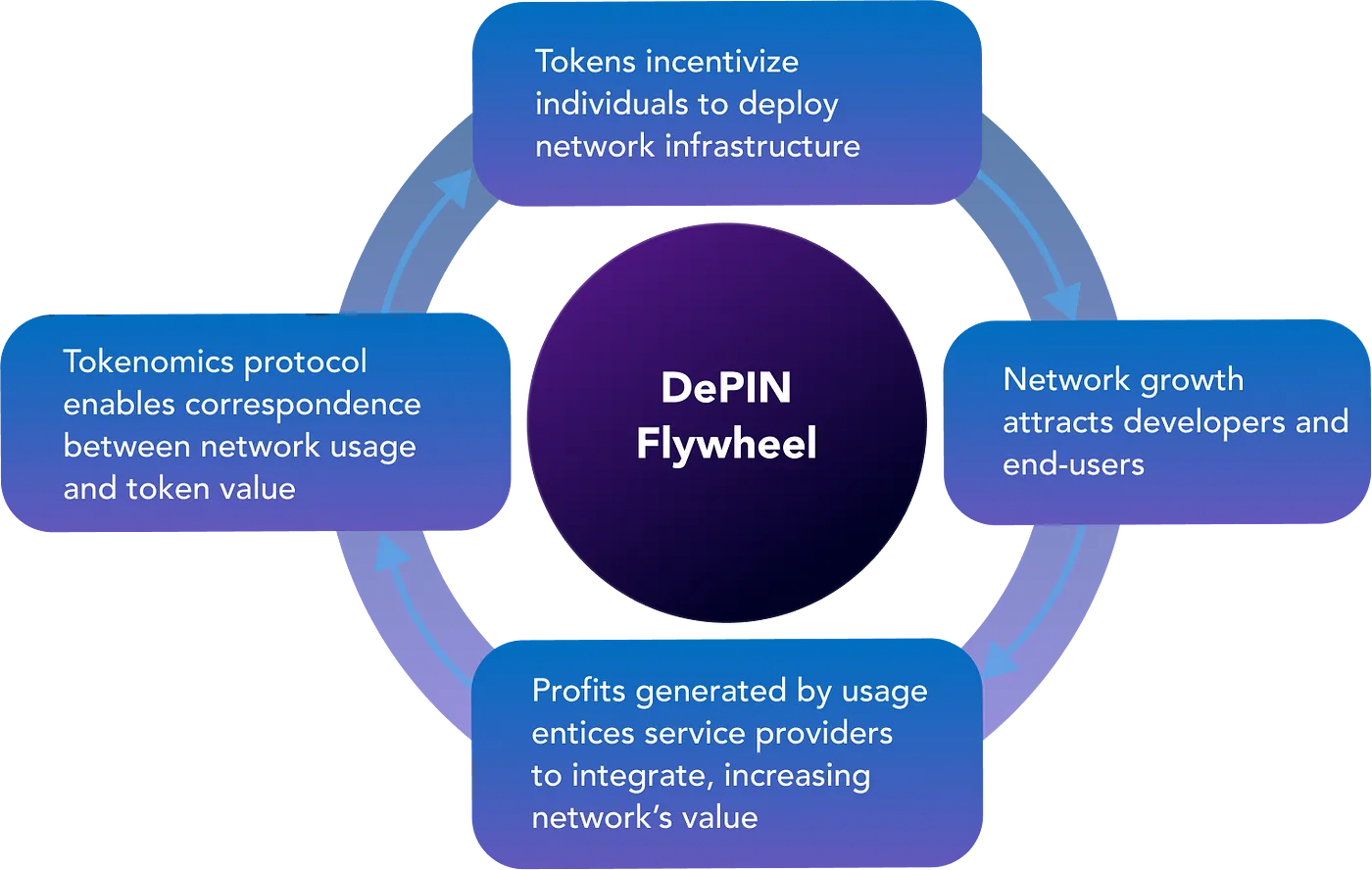

Once This Flywheel Starts, It Can’t Be Stopped

Here’s the best part: once a DePIN network reaches critical mass, it becomes self-reinforcing.

- More people contribute → Network grows faster

- Network grows faster → More people want to use it

- More people want to use it → Token demand increases

- Token demand increases → More people contribute

Source: Roam blog

It is very difficult for web2 incumbents to copy it.

- They can’t suddenly adopt this model, because their entire business is rent-seeking and their structure leech on unrealised arbitrage. Pursuing DePIN model would cannibalise their own revenue stream.

- They can't outspend it, because paying people in fiat is fundamentally more expensive than distributing tokens that represent ownership in what could become the next generation of global infrastructure networks."

- They can’t regulate it out of existence, because the network exists on its own, growing naturally. It is even less likely now under Trump administration.

This isn't about incremental improvements to existing systems. Rather, it's an economic model that offers fundamental advantages over centralised infrastructure across key metrics.

From a business perspective, DePIN networks present a paradigm shift in both capital expenditure (CAPEX) and operating expenses (OPEX). Instead of companies bearing the heavy upfront costs of infrastructure deployment and ongoing maintenance, these expenses are distributed across network participants who are incentivized through tokenisation. DePIN transforms traditional fixed costs into variable, market-driven investments while maintaining or improving service quality.

DePIN Is The Ultimate Onboarding Tool

DePIN is also well positioned to solve crypto’s biggest adoption problem.

For years, we’ve been trying to get more people onchain. The problem? The onramp experience is garbage.

- First, you need to sign up for an exchange.

- Then, you have to pass KYC.

- Then, you have to deposit money and pay commission fees.

- Then, you move funds to a self-custodial wallet.

- Then, you have to actually learn how to use it.

Meanwhile, in DePIN land:

- Plug your device and start earning tokens

- Congrats

The best way to get people into crypto is to pay them in crypto. The even better way? Pay them in crypto for doing valuable business activity that has actual clients in the meatspace.

Now, they’re not just earning some speculative asset—they’re getting what is effectively a share of productive work that has always had robust PMF and will appreciate over time so long as the work is useful. That’s why some DePIN leaders actually prefer the term “Proof of Useful Work” to ambiguous “DePIN”.

The true power of crypto lies not in speculative trading, but in creating systems where financial incentives are directly tied to valuable real-world activities. This approach of directly aligning economic incentives with productive work creates a more sustainable and meaningful foundation for a new financial system, which is what crypto is striving to create.

Breaking Down Capital Barriers: DePIN's Market Disruption

There are only two ways to break into a capital-intensive industry:

- Have billions in funding and wait a decade.

- Tokenise useful work and get there in two years.

Now that option 2 exists, option 1 is becoming increasingly obsolete. If you can identify useful work that aligns with token incentives, you've effectively unlocked access to a trillion-dollar market.

- Find the work → Tokenise the incentive → Let the flywheel build itself.

How are people not losing their minds over this? The markets that were once completely locked behind capital barriers are now wide open.

We envision that within a decade, a significant portion of global critical infrastructure will operate through distributed token ownership, managed by those who own and maintain the hardware performing essential work.

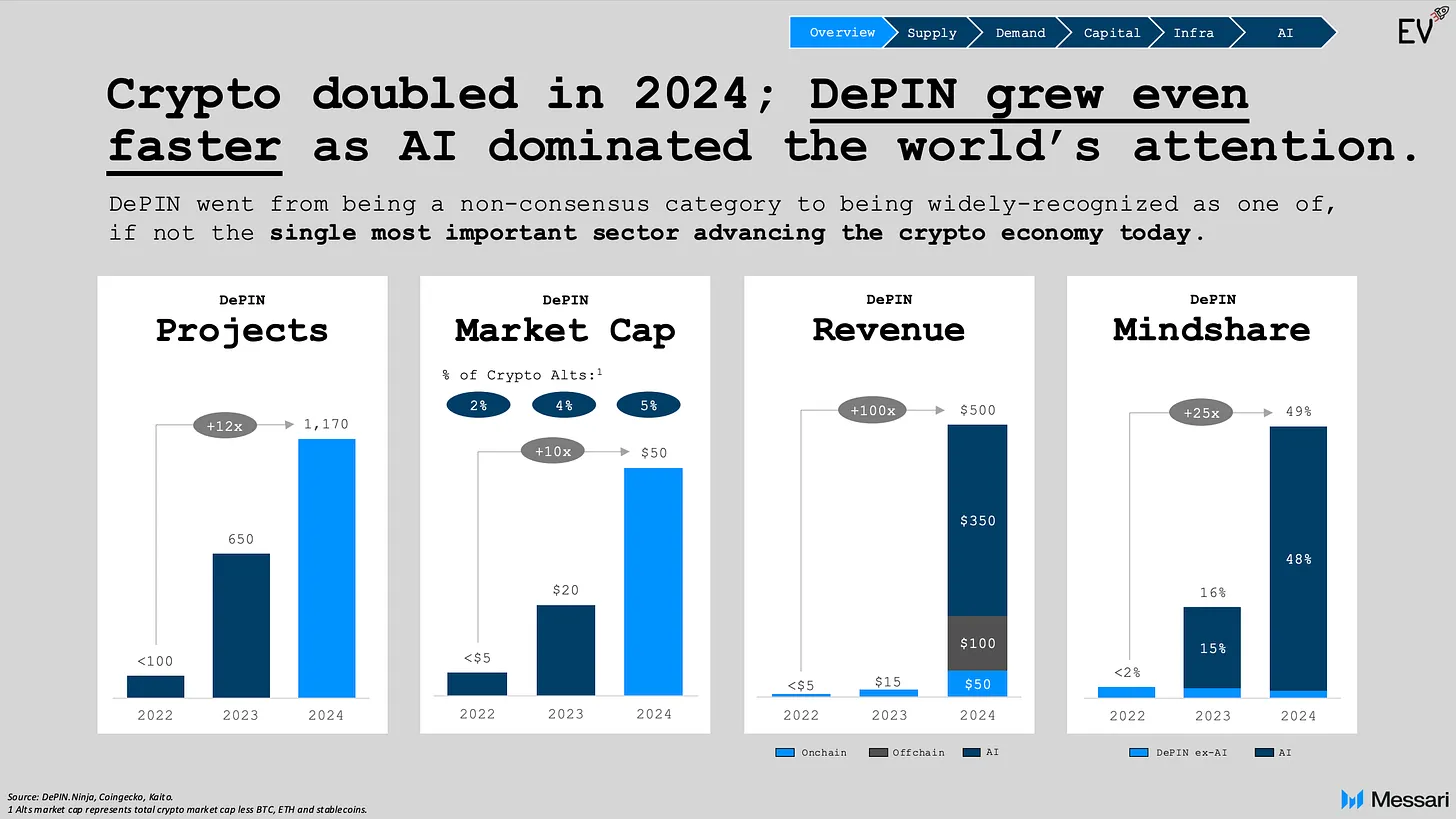

DePIN projects that have successfully identified valuable use cases and disrupted traditional industries have seen explosive growth in 2024:

As per our own estimates, the revenue is actually much more modest, closer to $100m range, which is nevertheless one of the most impressive sector expansion we observe on the market now.

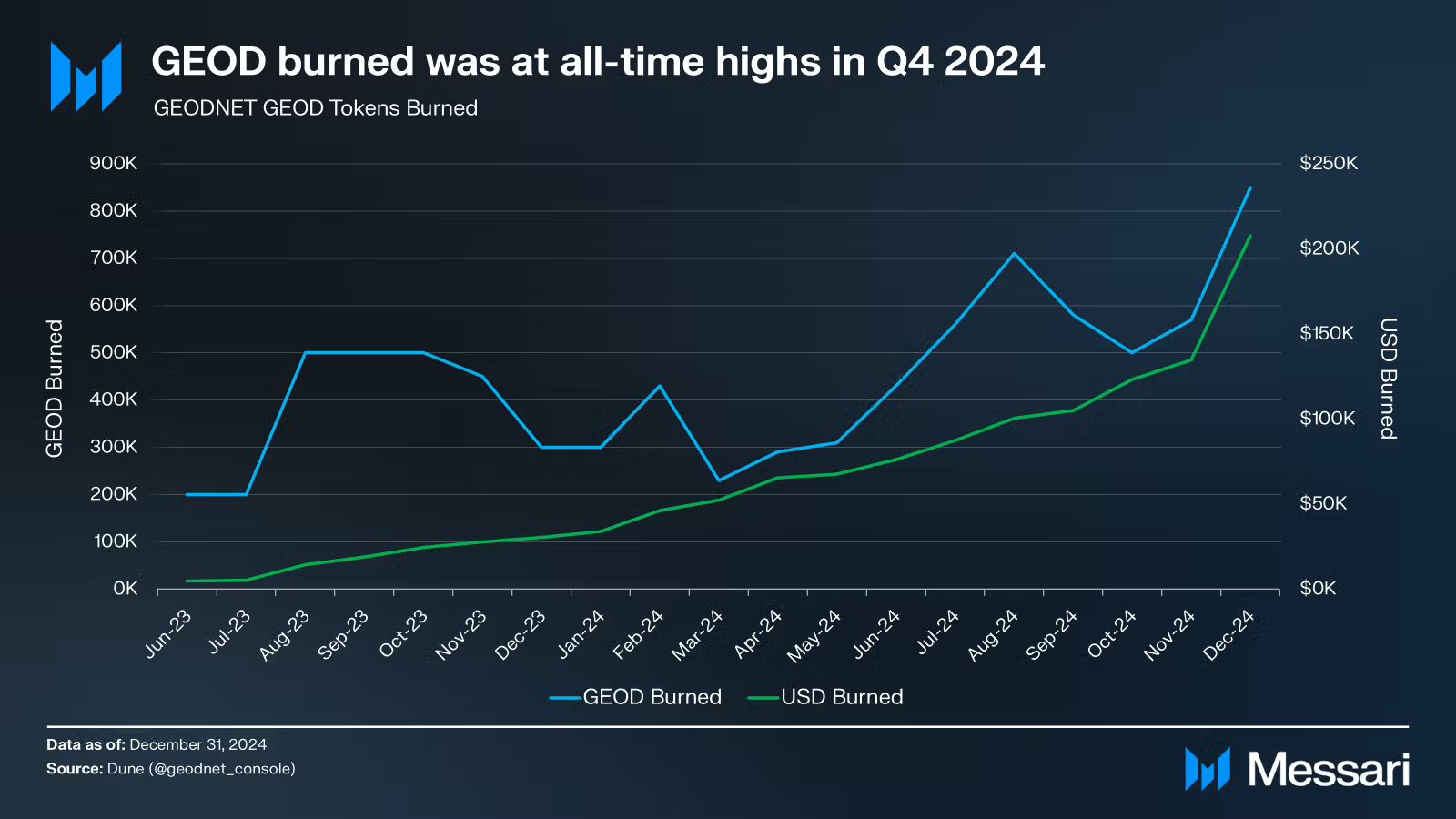

1. Geodnet (Decentralized High-Precision GPS)

What it does:

Geodnet is a location service that provides users with high-precision positioning data from its network of miners, improving location accuracy by a factor of over 200. Think of it as GPS with centimeter-level accuracy.

Customer Base:

- Autonomous vehicle companies that require centimeter-level precision locating (which normal GPS can’t do).

- Agriculture firms using RTK for automated farming equipment.

- Surveying & construction companies that need accurate geospatial positioning.

Why it matters:

- Incumbent RTK networks are extraordinarily capital intensive - where a single base station can cost $25,000, with an annualised rent cost per base station of $5,000.

- Geodnet crowdsources deployment, allowing users to run their own GPS base stations for just $500–$700.

- Enterprises pay less for GPS data, while node operators earn tokens for providing coverage.

Impact:

- Achieved **7.5x YoY revenue growth in 2024**

- 70x revenue growth since mainnet launch in Q1 2023 (= within 2 years)

- Expanded to 13k stations in 4377 cities becoming the largest RTK network on Earth within 3 years

80% of project revenue goes to burning GEOD token. Cumulative burn: worth of $200k on Jan 1, 2024 → $1.5m on Jan 1, 2025

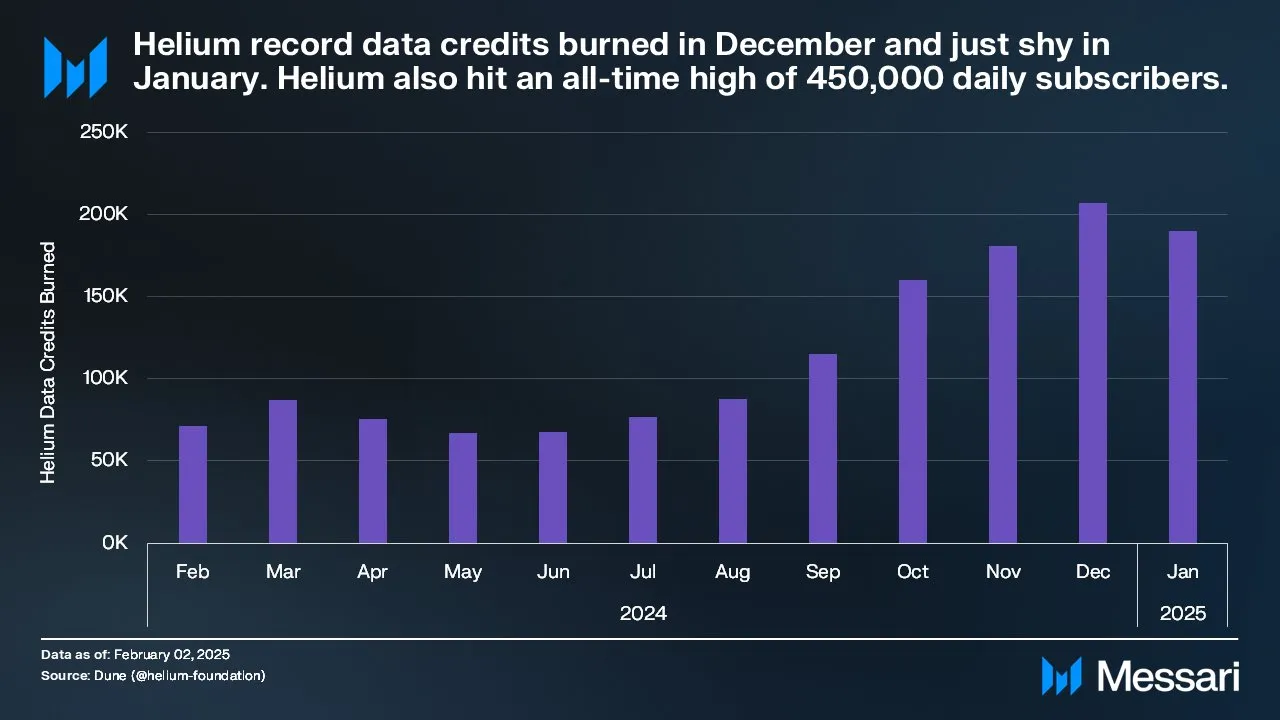

2. Helium (Decentralised Wireless Networks)

What it does:

Helium is a decentralized wireless network that allows individuals to deploy 5G and IoT hotspots, replacing the need for centralised telecom giants.

Customer Base:

- Cost-conscious consumers purchasing Helium Mobile plan 5-10x cheaper than they have used to.

- Individuals & businesses setting up personal mobile networks or offloading data.

- Decentralized ISPs using Helium’s network as a backbone for local internet services.

Why it matters:

- Beyond infrastructure and licensing costs, traditional telecom companies spend 3-5x more on operational expenses (OpEx), with labor, sales, and maintenance costs alone reaching tens of billions annually

- Helium's **hotspots cost only $249** and are deployed by individual users who naturally have zero operating costs

- Mobile plans are 80% cheaper than traditional carriers, made possible through HNT token rewards and now including a free plan

Impact:

- 25x growth in mobile subscribers since August 2024, with over 400,000 users now transferring more than 20TB of data daily

- 13x increase in mobile hotspot deployment, reaching over 20,000 active miners

- Record-breaking data credit consumption in December 2024

- Six carriers participating in the carrier offload program including T-Mobile, AT&T, Telefonica.

Data credit burn results in HNT burn. Current burn implies ~$3m ARR excluding offchain revenue

3. Akash Network (Decentralized Compute)

What it does:

Akash is a decentralized cloud computing marketplace that allows users to rent out idle computing power, offering a cheaper alternative to AWS, Azure, and Google Cloud.

Customer Base:

- AI/ML developers needing affordable GPU computing for training models.

- Web3 applications running decentralized services without relying on Big Tech.

- Small businesses & AI startups looking for cost-effective cloud computing.

Why it matters:

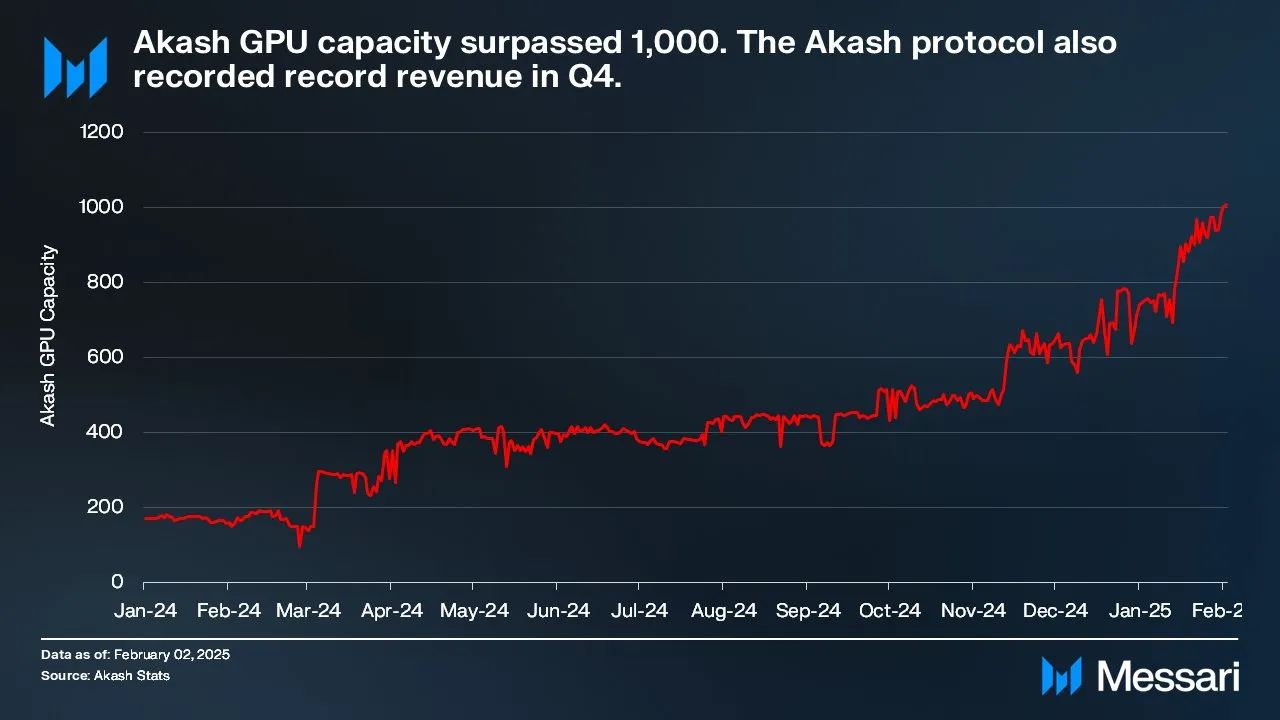

Impact:

- Leases doubled YoY 150k → 300k

- 9x revenue growth YoY currently pacing around $4m ARR

- GPU capacity 10x growth YoY surpassing 1k GPUs ready for lease

10x growth in GPU capacity YoY → 9x growth in ARR

4. Hivemapper (Decentralised Mapping)

What it does:

Hivemapper is a decentralized alternative to Google Street View, rewarding users for collecting street-level imagery using dashcams as they casually drive around.

Customer Base:

- Logistics, delivery and ride-sharing companies needing up-to-date road and infrastructure data.

- Autonomous vehicle firms training AI models with real-world street-level views.

- Navigation app developers building decentralized mapping solutions.

Why it matters:

- Google spends $1B+ annually on proprietary mapping fleets. One mapping car costs them around 500k/year (the sensor, the car itself, insurance, driver’s salary, etc.)

- Hivemapper’s contributors use $300 dashcams, earning HONEY tokens for mapping new areas.

- Enterprises get access to mapping data at 10x lower cost per mapped mile.

Impact:

- Hivemapper has mapped 30% of the world’s roads within 2 years growing 5x faster than Google Street View ever did

- >400 total km mapped, 4x YoY growth

9m AI trainer map data updates every month = 3.5x growth YoY

- 4x HONEY Contributors growth: 40k → 160k YoY

- Q4 2024 - Q1 2025: new partnerships including a leading ride-sharing public company and three top global map providers resulting in

- Record HONEY burn in December 2024 ~$200k

Implied ARR is difficult to extrapolate such that it makes sense because the burn occurs in sudden spikes as large clients prolong the service via purchasing more Map Credits which in turn lead to HONEY burn. Currently pacing around $2m.

The next trillion-dollar companies won’t be only software platforms — they’ll be token-powered networks streamlining financial incentives disrupting multiple PMFs in the meatspace. And they’re being built right now.

There are many many more worth DYORing. See the list at the end of the article.

According to the data from Messari, the valuation of the DePIN market is expected to surge to $3.5 trillion within the next four years and more than $10 trillion in the next decade and $100T in the decade after that.

So let me ask again: How are you not talking about this?

For a deeper dive, proceed to the following:

- The legendary Proof Of Physical Work by Shayon and Tushar of Multicoin Capital

- 2024 State of DePIN by Messari

- DePin Ninja Research Section and newsletters

- Ryan of Blockworks reporting on decentralised compute and Hivemapper (subscription required)

- Geodnet’s founder TL;DR on Physical AI x DePIN (robots, drones, sensors)

- Karam of Dabba is sharing a great example of market sizing a strong PMF that's vulnerable to DePIN disruption

- Ben and Harry of Gensyn unpacking decentralised compute market

- Syndica on Solana DePIN in 2024 round up

Further DYOR for those interested:

+ many more that are welcomed in the comments below