Why we are in crypto, what we invest in, and why it is a good idea.

Author: Mark Leontev

Below is our high-level Crypto Investment Thesis, gently delivered to you by the DeepWaters team. It strives to explain why we believe investors should man up and consider being in crypto full time. Enjoy.

Investors who take a thoughtful approach to their job often distill their investment decisions down to a core idea or assumption. This underlying concept is commonly referred to as an “investment thesis”. In essence, it serves as the foundation upon which their subsequent investment choices are built. Here’s an example of what an investment thesis might look like:

Many instantiations can be found and the wording will slightly differ but the bottomline of it all — “Crypto will shift wealth and melt faces” — that’s our formula at DeepWaters. Even though we are by no means sophisticated people, we share this believe, and we would like to elaborate.

In crypto, we often tend to bog down into the midcurving of comparing ecosystem tribes, arguing over which blockspace is fat and sexy and what province of France should decentralisation come from to be recognised as such. It is important to filter out the noise and concentrate on what really matters.

We’re genuinely supportive of crypto as a face-melting instrument, but we anticipate that the future of crypto will diverge significantly from its past. Let’s dive into it.

The lengthy echo of 2008

Satoshi Nakamoto embedded the following message in Bitcoin’s genesis block:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

This was no mere footnote to the 2008 financial crisis — it was a direct response. Yet, over time, we’ve largely dismissed its significance. We kinda-sorta acknowledge that Bitcoin emerged as a cypherpunk reaction to the global meltdown, but the full implications remain overlooked or ignored, both within and outside the crypto space. Let us recap.

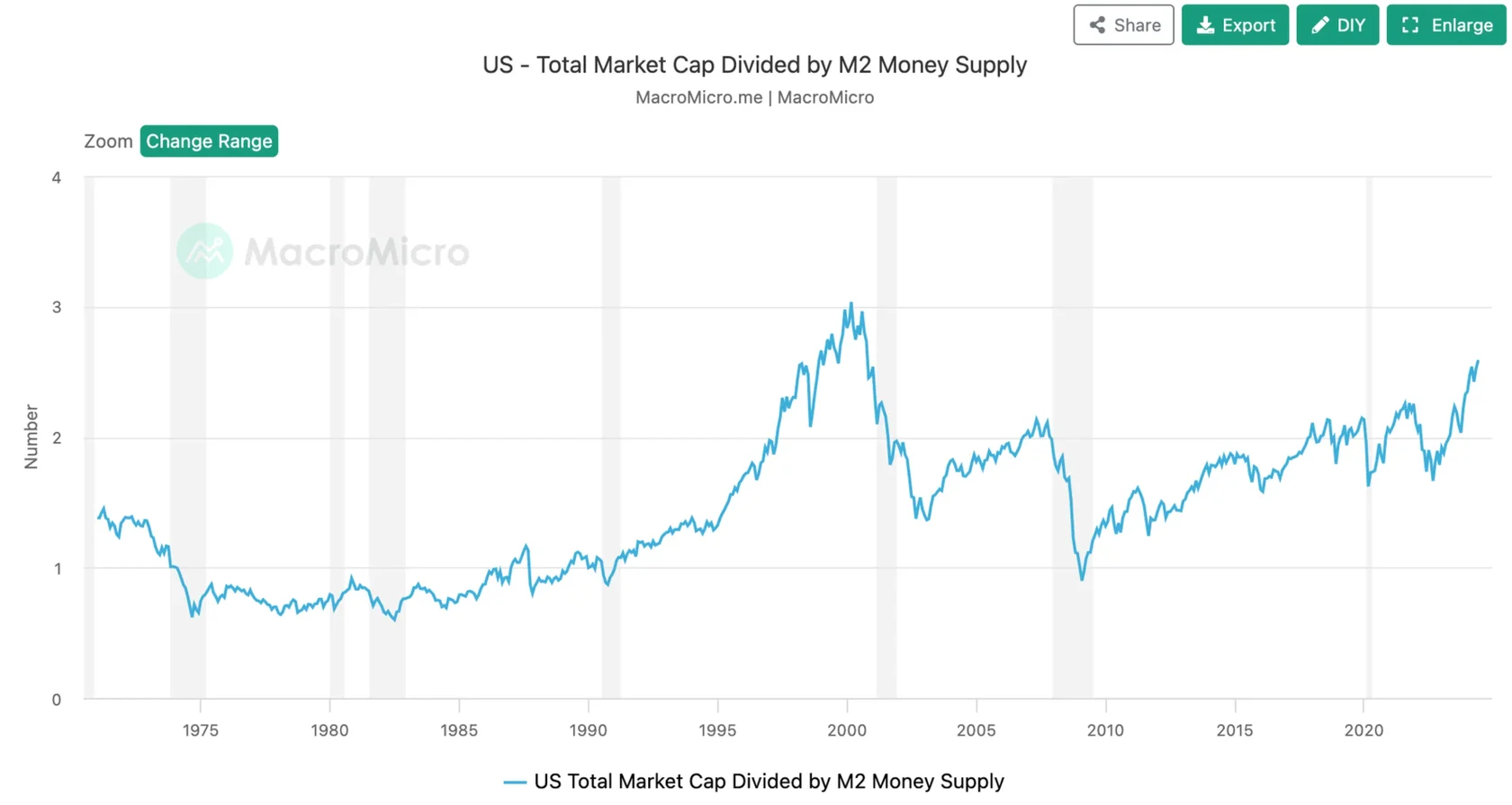

In 2008, the Federal Reserve broke from its traditional focus on adjusting short-term interest rates, taking unprecedented actions to combat the financial crisis. Former Fed chairman Paul Volcker noted that these measures “pushed the boundaries of its lawful and implied powers,” underscoring their extraordinary nature. To prevent a financial meltdown, central banks, including the Fed, acted to prop up asset prices and avoid a vicious cycle of debt defaults and sell-offs. This approach, which was repeated during Covid, involved inflating the money supply to stabilise the economy by artificially supporting asset values.

We’ve effectively separated markets from the economy. Wall Street now operates in a different universe from Main Street. Never before have we seen a policy so explicitly designed to prevent debt deflation. No matter what happens, regulators step in, bailing out entire asset classes, sectors, and even jurisdictions through currency debasement.

This prevents markets from undergoing a true reset in terms of real value. While they may not intervene in every situation, there’s a growing expectation that they will always consider direct involvement. The most recent example was Silvergate in 2023. The global application of such policies across major jurisdictions results in an average 7–8% debasement — a maintenance cost we all bear annually.

Here’s what it means to us investors:

Nothing really goes up in real terms. Pretty bad, right? So, you better be stacking sats on cold storage in your doomsday bunker.

Pretty bad, pretty good

But here comes the first important point — hard money investors and advocates often focus heavily on the ethical merits of their approach, aspiring for an economy where currency debasement does not erode value, yet this perspective simplifies the multifaceted nature of economic debasement. Besides its obvious downsides, the debasement system offers notable benefits and conveniences; as Raoul Pal insightfully notes, the cost of annual currency debasement functions much like a put option, providing a safeguard against the entire economic system collapsing, thereby serving as an insurance for macroeconomic stability.

Put simply, it means central banks’ policy of debasing the currency by about 8% on average each year ensures that asset values don’t crash because the increased money supply keeps prices afloat. From an investment standpoint, it means you are offered a sandbox regime where you cannot screw yourself by investing in a bubble. Doesn’t mean you cannot lose money but the blow-up factor is mitigated. And this is exactly the point where Wall Street starts diverging from Main Street giving birth essentially to a premium market deprived from left-tail risks. It’s a premium product, and the access fee is 8% a year. Pretty good, right? That’s the foundation of post-2008 regime.

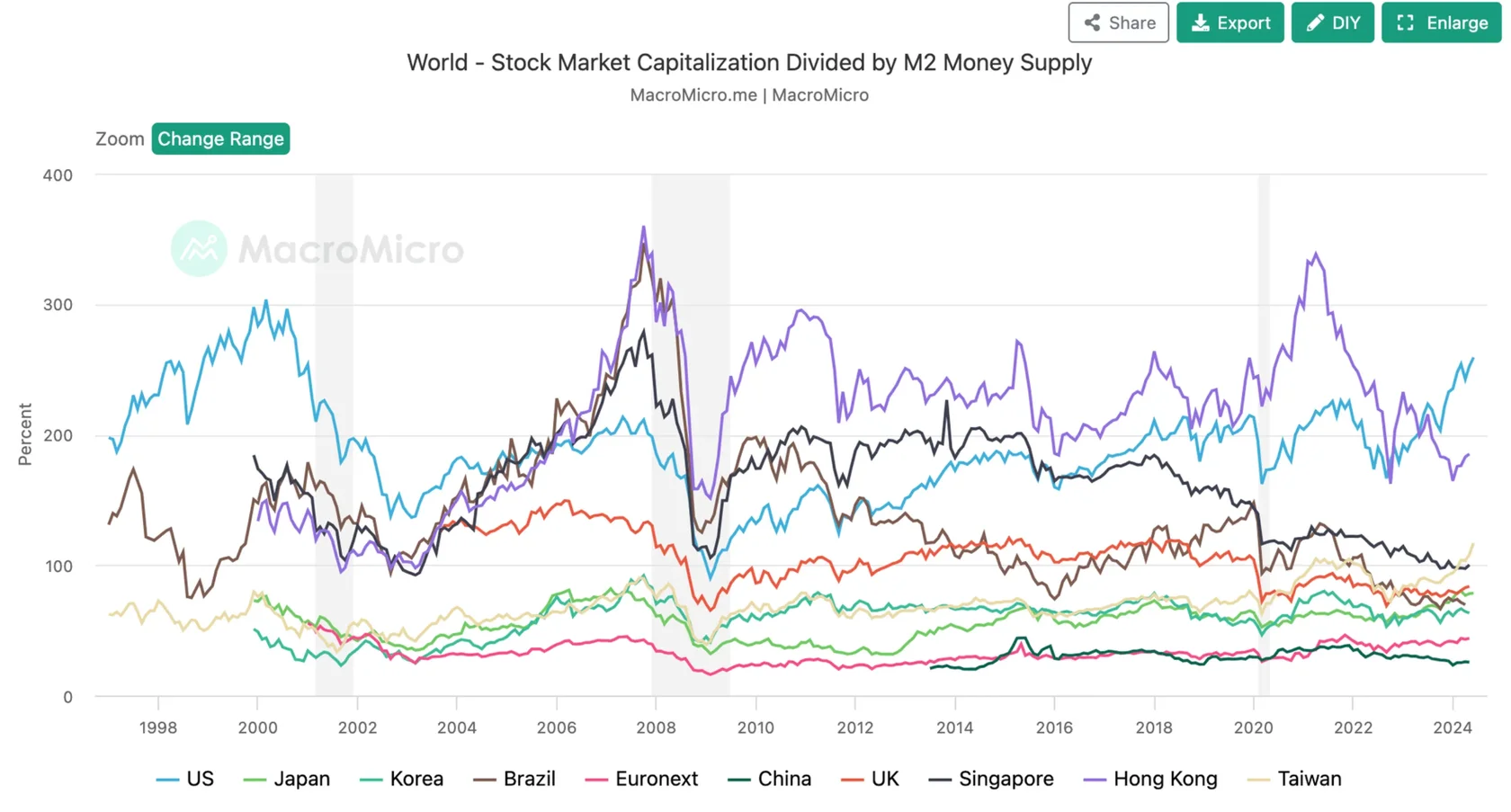

This regime increasingly favours participants who gravitate toward a few key asset categories — blue chip equities and real estate. These sectors absorb the bulk of liquidity, driven by the expectation of appreciation. As concentrated inflows push their values higher, these assets evolve into proxies for debasement, serving as the primary means of wealth preservation.

Post-2008, you need to spot something that meaningfully outperforms preservation benchmarks, and the market has spoken as to what it is. Technology stands out as the only asset that truly goes up in real terms.

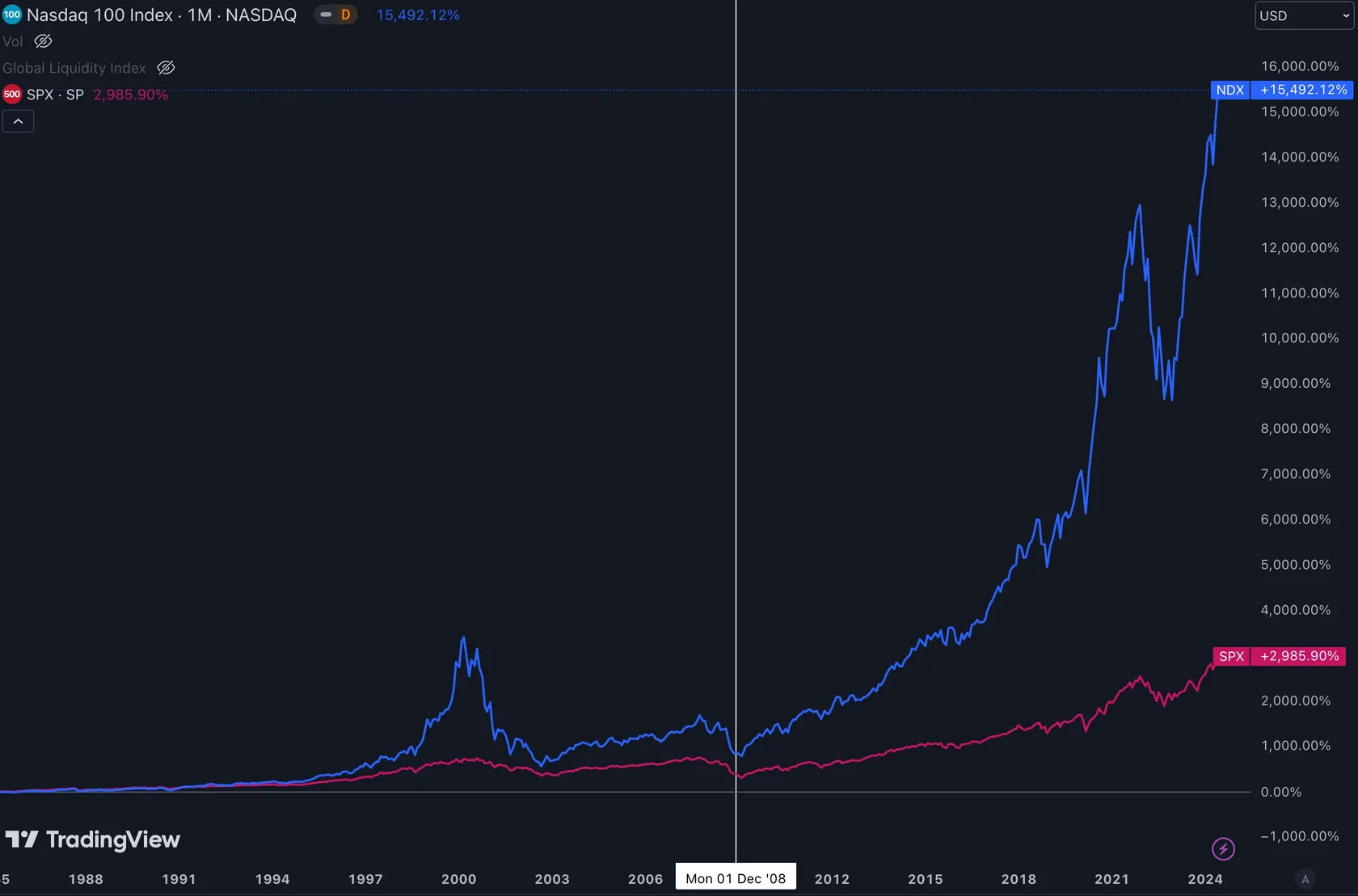

🟠 — Nasdaq 🔵 — M2 of USA, EU, Japan, China in $ terms

Nasdaq vs Money supply — 4x since 2008. Pretty good.

🔵 — Nasdaq 🔴 — S&P 500

Nasdaq vs Broader market — 5x. Notice how the gap has been widening since 2008 as the inflows concentrate around the Big Tech. Pretty good.

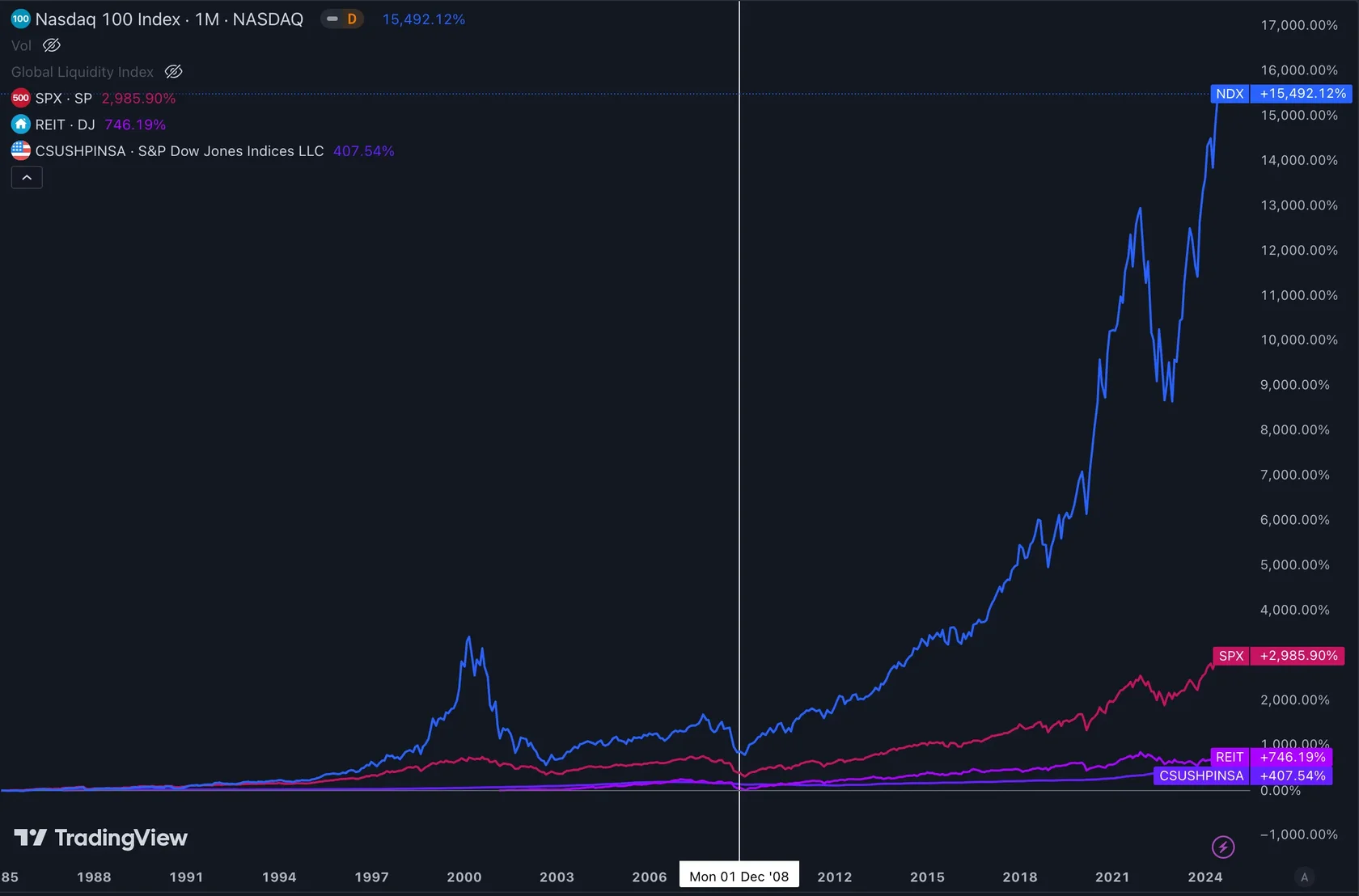

+ real estate tickers

In today’s market, the real challenge is recognising just how meaningless diversification has become.

Technology now dominates, making investments outside of it a losing game. The global returns from tech have rendered traditional diversification across bonds, stocks, commodities, and forex obsolete — a relic of the past. With left-tail risk off the table, spreading your investments around no longer pays off.

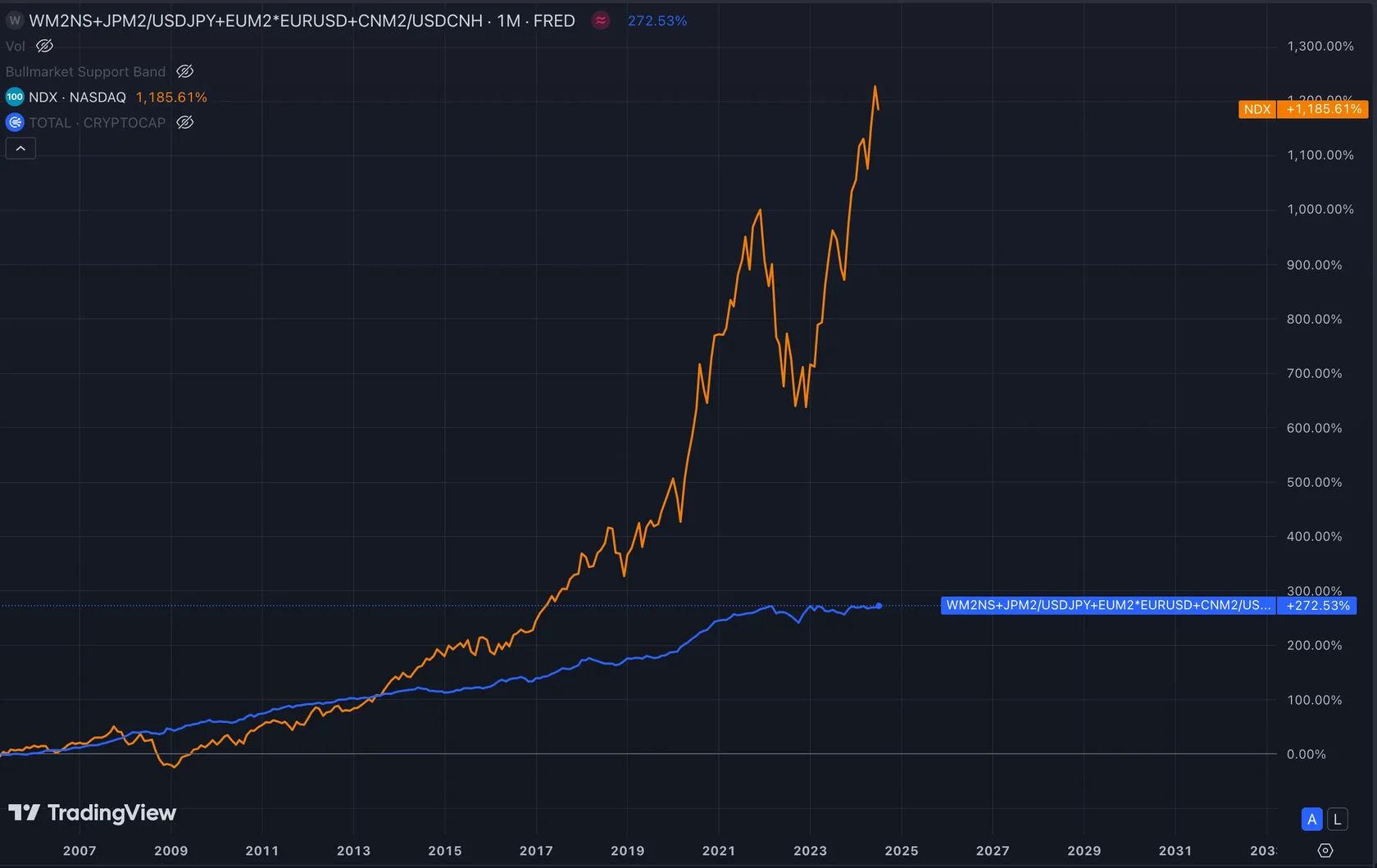

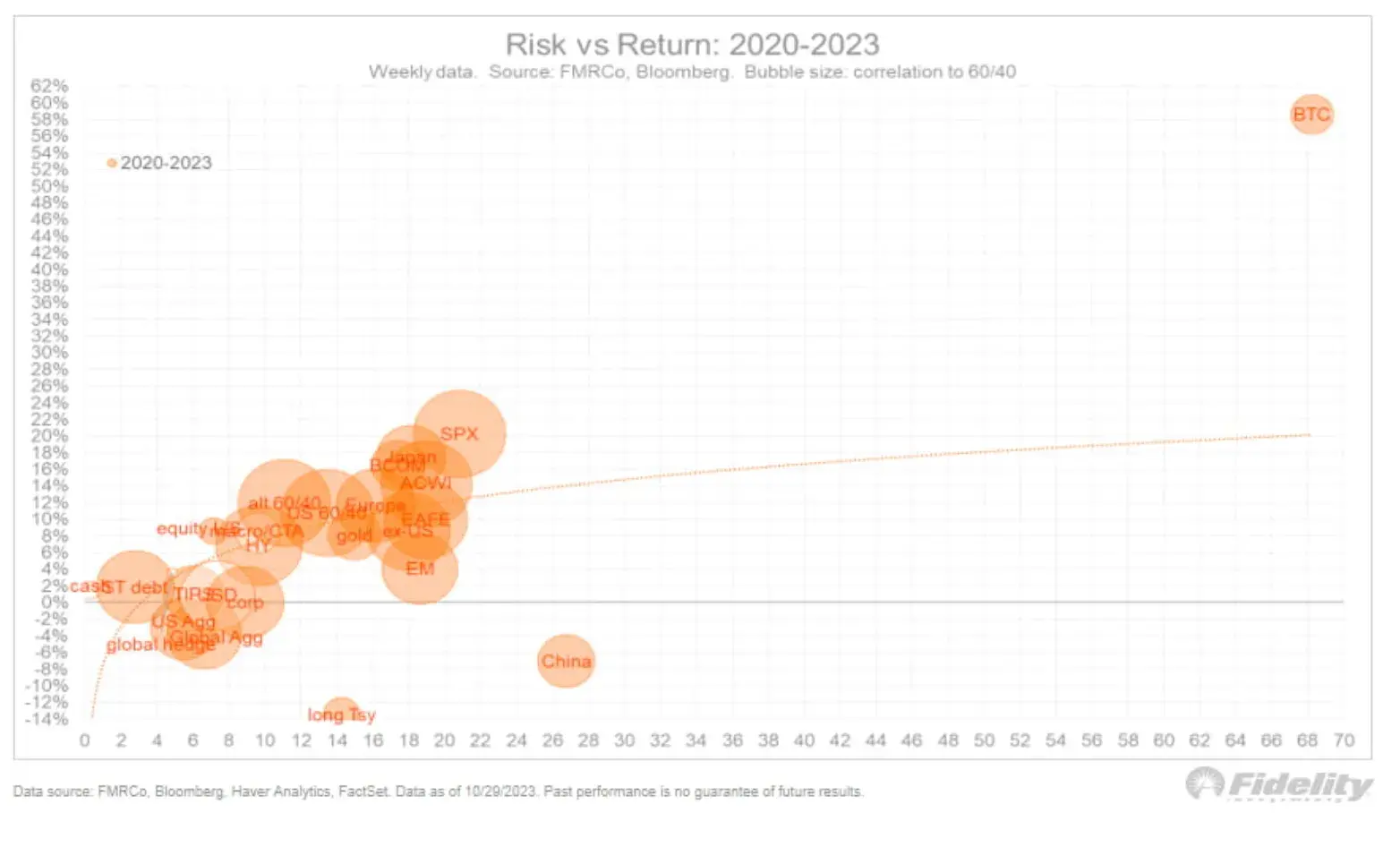

Now, we are accustomed to group Crypto firmly under the Technology umbrella, and that’s when things really start to go off the rails. The charts above show the Nasdaq’s outperformance relative to other markets, and if you find that impressive, wait until you see this one:

Crypto VS Nasdaq VS Money Supply — 40x outperformance within last 10 years

Bitcoin’s performance has been unprecedented in financial history. If we calculate returns from around 2010 to 2011 up to the present day, Bitcoin has shown an extraordinary growth, exceeding 5,000,000% in certain calculations. Pretty, pretty, pretty damn good.

When you’re dealing with Technology’s outperformance, and within that, you find a 5-million-percent frontier asset, you realise there’s only one game left to play — being less late than your peers to abandon 60/40 and other relics of the past. Investing in anything else seems almost absurd.

The staggering return has driven even the most level-headed investors to the brink of mania. Jan van Eck boasts he’s “way over 30% in BTC” — and so is everyone he knows. Michael Saylor’s single, “Second Best,” seems destined for The Rolling Stones’ Top 500 Greatest Songs of All Time.

Jurrien Timmer, Fidelity’s Director of Global Macro, conducted a risk-reward analysis on various assets, including Bitcoin, and the results were so astonishing that even he was taken aback. As he put it, “Bitcoin’s risk-reward is in a different universe.”

And the longer your time horizon is, the more ridiculous it becomes.

Post-2008 regime has given birth to an environment with diminished left-tail risk where investors pay 8% premium to access the value capture technology sandbox. And crypto has been hands down the best sub-category in the Tech sandbox.

Crypto The Money

There’s only one fundamental issue here, and it can be easily spotted by any Bitcoin OG. If you ask them “What is Bitcoin” they will tell you “Bitcoin is money”. Satoshi Nakamoto’s innovation incorporates technology but is not itself a technological advance. It’s “peer-to-peer electronic cash”. Cash is, by definition, not technology.

Over the past decade, crypto development has largely been a series of experiments with cash-like assets. While Bitcoin isn’t the only player, many top projects can be categorised as attempts to create superior forms of money — whether fixed-supply, ultra-sound, tokenised dollars, or modular money. Currently, up to 75% of the crypto market falls into this “Crypto The Money” category, including BTC, ETH, USDT, and USDC. The remainder of the market, until recently, has been dominated by dogs floating around in empty blockspace.

Money, as it stands, is a significant issue. Crypto has spent over a decade trying to address the broken money problem by acting as a hard commodity. However, several issues arise with this approach:

- Economic Dynamism: A healthy economy needs to expand and contract based on productivity and innovation. A fixed money supply can hinder this dynamism, potentially leading to deflation, which is as harmful as excessive inflation.

- Wealth Distribution: In a deflationary system, those holding money gain purchasing power over time without contributing productively, exacerbating wealth inequality and reducing economic activity.

- Debt and Investment: Inflation encourages investment and responsible borrowing. Deflation, on the other hand, incentivises hoarding rather than investing in productive ventures.

- Adaptability: Flexible monetary policy allows responses to economic shocks. A rigid system lacks this adaptability.

- Global Acceptance: For a currency to function globally, it must be able to expand with the global economy’s needs. A capped supply might limit its adoption and utility.

Byron Gilliam from Blockworks recently penned an optimistic newsletter that highlights the many wonders we’ve achieved as civilisation. All of them pertain the acceleration age that began after we moved away from the gold standard.

"We already live in an amazing world of remote surgery, hydrogen-powered helicopters (300 mile range with no emissions other than water), humans talking to whales, audio books read by dozens of actors, exoskeletons that let people work longer in labor-intensive jobs, sideloading trucks, beaches that remove carbon from the ocean, HIV vaccines, the imminent prospect of cancer vaccines and longer lives, plug-in solar panels, and concrete that doubles as a battery.

I think we should stop taking these wonders for granted."

There are 13 hyperlinks in that paragraph, thank you very much. That’s 13 illustrations of what hard money economy will struggle to achieve. If you look around, you will probably spot a hundred more. It can be argued that non of those things would have been there for you had we not moved on from the gold standard. Given BTC stock-to-flow is even harder than Gold, you can imagine where we would have been on the standard that is that hard.

Introducing hard commodity money as a solution to the debasement problem might sound compelling, but it won’t dismantle the 8% sandbox. Instead, it would shift the benchmark dramatically, making it 60%. If corporations used Bitcoin’s historic returns as their cost of capital, they’d simply buy Bitcoin, which would boost its price but halt job creation and innovation. No possible venture is incentivised to be undertaken under such environment.

75% of the cryptocurrency sector does not aim to advance technology. Instead, it seeks to be adopted as the “better currency of tomorrow.” While the market has been placing a high multiple on this concept, its success from a fundamental perspective remains debatable. With over 90% of Bitcoin’s supply already in circulation and less than 5% of the global population having adopted it in some form (primarily as a store of value) the actual impact is questionable.

Stake-to-float, unburdened by what has been

The 8% sandbox environment is a well-known issue in crypto, believe it or not. Nerdy people on Twitter often discuss it under the question “Is issuance a cost?” It’s one of the most traditional crypto means to ensue a digital massacre.

In crypto, we debate whether token issuance is a cost for tokenholders. In theory, a proof-of-stake (PoS) system should mitigate the inflation concern because it is designed for people to stake. Staked assets absorb emission pro-rata as they deliver emission rewards, increasing the denominator and thus negating inflation externalities. This option is permissionless — anyone can participate, making supply inflation a choice rather than an imposed cost. You only suffer inflation in crypto if you choose not to stake.

Outside crypto, it’s not a choice. In the post-2008 sandbox environment, only limited number of investors are allowed to participate. People invest in blue chip assets as a safeguard against money supply expansion. Even with returns barely outpacing inflation, owners are effectively “staked,” keeping their purchasing power somewhat afloat —it’s a stake-to-float system. But who can access this setup?

The unbanked can’t stake. Sanctioned jurisdictions can’t stake. Many in hyper-inflationary countries can’t stake. The poor can’t stake. Millennials often can’t stake. Productive emission benefits aren’t universally accessible. This is precisely the problem modern crypto is best positioned to solve.

PoS democratises value creation, allowing universal participation unlike traditional finance. The optimal strategy for PoS systems isn’t competing as money, but equipping the existing sandbox with better-designed assets. By prioritising transparency, equality, and composability, PoS can create blue-chip digital assets that enhance the current system rather than replace it. This approach leverages crypto’s technological advantages to build a more inclusive, efficient financial ecosystem, focusing on improving design rather than just monetary policy.

The total addressable market of such system is the entirety of global finance, as it is a global utility system, much like the internet before it. What’s different this time is — unlike previous global utility shifts, individuals now have the opportunity to invest directly in this transformation.

The scope of this market is currently sitting around $2–3 trillion. If the appreciation rate continues as projected, this could grow to $100 trillion by 2032. This growth represents the most significant wealth redistribution opportunity in human history.

We believe the next stage of the shift is not going to revolve around crypto the money. It’s going to explore the broader benefits of crypto the tech, which is the only feasible way to deliver on something of real value rather than just “token go up” ledgers.

Crypto The Tech

Our investment thesis is that as the cryptocurrency industry continues to mature and attract more mainstream investors, the technology underlying it will outperform the monetary aspects of crypto over the next decade just like the Nasdaq index has outperformed money markets.

On the infrastructure layer, we define “crypto the tech” as systems that:

- Are built to enable innovative businesses from day one (most crypto incumbents were not, being explicitly or inexplicitly money).

- Prioritise development towards valuable use cases uniquely enabled by crypto (crypto money are prone to enable things that are doubtfully valueble outside their ledger).

- Can scale without compromising essential crypto parameters such as resistance, security, permissionlessness, and composability (most of the money L1s can’t scale efficiently).

Crypto the money focuses on propelling its native coin, effectively trying to dethrone other forms of money. These systems convey: “Hey, crypto is money, which is why all the other cryptos are just a bunch of shitcoins.” They are optimized for decentralization, censorship resistance, and preparing for worst-case scenarios. They build towards dark times and double down on security.

In contrast, crypto the tech says: “Hey, there’s an opportunity to rebuild the entirety of global economy.” These systems are optimized for scaling, cost efficiency, and business. They build towards an optimistic future and double down on product development.

We believe that real crypto-enabled innovation lies in the latter, and it has not yet been fully realised. This process is only beginning to gain momentum. As it stands, we believe it’s been a couple of years since we have seen the emergence of tech-crypto layers that can potentially accommodate this thesis and, more importantly, explicitly build towards this vision.

In fact, they have recently been so successful along their journey that they directly impact the money-crypto layers, which now need to react and adapt to the change. The thesis has just started to play out. It took us 10 years to figure it out, and there’s plenty of time ahead.

The 2x Framework

To give you a high-level view of what crypto the tech might look like at the application level, I use a framework I call The 2x Thesis. This isn’t about 2x ROI though.

It stands for eXponentially eXpandable (solutions for economic growth) and it posits that there are things that are by design exponentially expandable while there are other things that are not. For example:

1. Software is 2x, Hardware is Not

AI products have one of the deepest product-market fit. They seem to serve as the backbone of tomorrow’s economy. AI needs compute, but there’s a huge shortage of it because compute needs chips, and chips aren’t exponentially expandable — they take time to produce. Software, on the other hand, is exponentially expandable.

The compute shortage can be mitigated by developing orchestration software that aggregates idle remote computers to power AI startups. This approach leverages existing hardware more efficiently, creating a virtual supercomputer network without new hardware investments.

2. Robots are 2x, Population is Not

As global population growth slows down, GDP growth will increasingly rely on AI and robotic automation. AI agents can perform tasks traditionally done by humans, boosting productivity and economic output. This shift will not only compensate for labor shortages but also drive innovation across sectors, from manufacturing to services.

3. Physical Infrastructure is Not 2x, Social Coordination Is

While physical infrastructure has limitations, social coordination can be exponentially improved through aligning incentives via token that accrues value related to the work done by the infrastructure. These startups will disrupt traditional markets by enabling more efficient and scalable solutions for logistics, transportation, and urban planning. Enhanced social coordination will lead to smarter cities and more resilient communities.

4. 5. 6. … are coming soon, stay tuned for more ideas.

Many such theses, uniquely enabled by tech, will play a crucial role in this transformation. Proof-of-Stake systems will be at the forefront, paving the way for tomorrow’s economy.

The upcoming era of real crypto unlocks will be driven by technology that enables exponentially expandable solutions for GDP growth. The best way to facilitate such solutions is crypto. “Crypto the Tech” can address current economic challenges and secure sustainable growth.

P.S.

Read along the blog to see which ledger(s) we believe are best positioned towards this future.

Read along the blog to know which teams we believe are building the 2x products.

If you think you’ve noticed financial advice being offered across the article, dm me on Twitter, and I will tell you who you are.

Use my promo code “DONTBEAPUSSY” to secure the largest wealth shift in human history.